Some interesting notes on the effects of Donald Trump's major economic policies — notably tariffs — on Australia and our largest trading partner, China.

First to China, which Julian Evans-Pritchard from Capital Economics says wouldn't necessarily be as badly affected by US tariffs as many suppose.

"We estimate that the direct impact of even a 60% US tariff on goods from China would be well under 1% of China's GDP," noted Evans-Pritchard, adding that is could even generate a short-term boost as buyers brought forward imports to beat the tariffs.

"The bigger challenge for policymakers could be the pressure this would put on the renminbi.

"The impact of US tariffs would be magnified if they triggered a broad global retreat behind protectionist walls. But we think that other major trading economies and China itself are likely to want to preserve many of the benefits of open trade.

"Indeed, a pivot to tariffs and isolationism by the US that antagonised traditional allies might provide an opportunity for China to undermine Western controls on its access to strategically-important technology."

So, as many economists have argued, big tariff barriers could be a huge own goal for America.

What about Australia? It's not only the Reserve Bank that is reasonably sanguine about the likely effect of Trump's tariffs here.

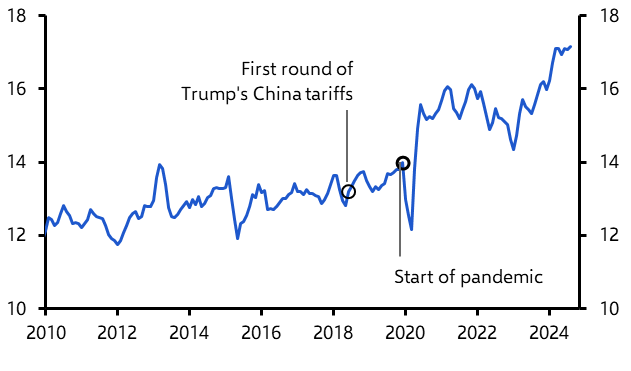

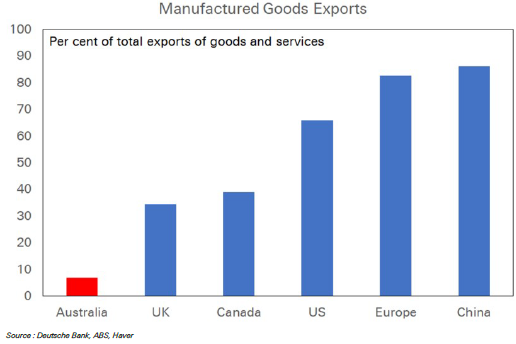

Deutsche Bank's Phil O'Donaghoe says Australia has a "tariff resistant export basket" due to our over-reliance on commodity sales and relative under-reliance on manufactured goods exports.

"If tariffs challenge China's ability to pursue export-driven growth, authorities will likely look for growth elsewhere," O'Donaghoe continues.

"Infrastructure spending is an attractive alternative, and that would be supportive for iron ore prices."

He says that could drive iron ore prices back as high as $US130 a tonne, in a boost to mining profits, national income and the federal (and WA) budget bottom lines.

But Julian Evans-Pritchard does have one major concern about the incoming Trump administration's China policies — that is uncertainty around its attitude towards Taiwan.

He says the views of people in Trump's wing of the Republican Party range from hawks who will take a hard line to protect Taiwan against China to those willing to make big concessions around the sovereignty of the island, which China views as a breakaway province.

He warns this risks potential conflict, which would have disastrous economic and human consequences.