Tim Lawless, Research Director, CoreLogic Australia, has taken a look at rising mortgage arrears and "riskier" lending loan trends.

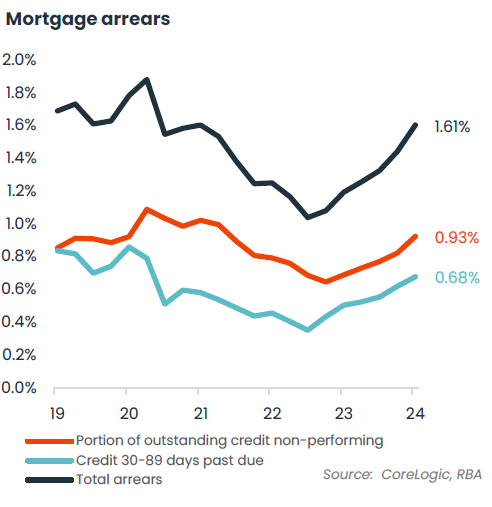

He says mortgage arrears have been rising from the COVID lows and reached 1.6% in the March quarter.

It's the highest reading since early 2021, but it hasn't yet reached pre-COVID levels.

See the black line below:

Mr Lawless says the upwards trends in arrears has been most influenced by non-performing loans, where the arrears rate has risen to 0.93%.

A non-performing loan is one that is at least 90 days past due or where the lender expects it won’t be able to collect the full amount due.

The non-performing arrears rate is now slightly higher than it was at the onset of COVID (0.92%) and above the series average of 0.86% (see the red line in the graph above).

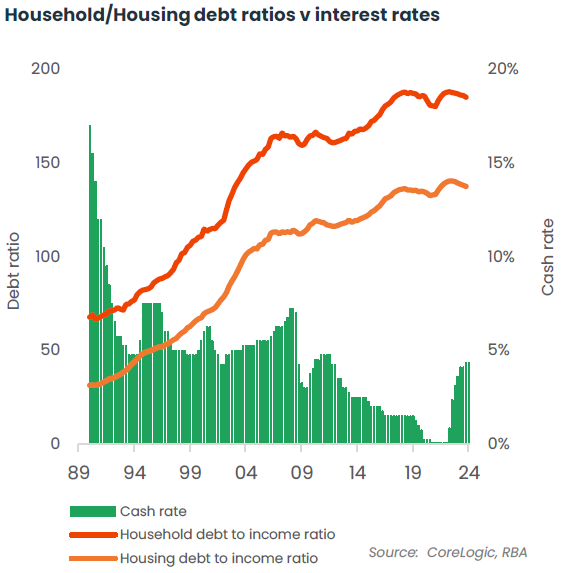

He says akey factor in higher mortgage arrears is obviously the sharp rise in the cost of debt.

With the average variable interest rate on outstanding owner-occupier home loans rising from 2.86% in April 2022 to 6.39% in March 2024, a borrower with $750k of debt would be paying nearly $1,600 more each month on their scheduled repayments.

But there are other factors at play as well.

He says cost-of-living pressures are consuming a larger portion of household income, households are paying more tax than ever before and household savings are being drawn down, eroding the savings buffer accrued through the pandemic.

There is also the fact that households are more sensitive to sharp adjustments in interest rates, given historically high levels of debt, most of which is housing debt.

See below.

But most borrowers are still on track

However, Mr Lawless says although each measure of mortgage arrears has risen to be above the series average, which is relatively short at only five years, despite the headwinds outlined above, most borrowers have kept on track with their home loan repayments.

He says they've done this by drawing down on their savings, working more hours or multiple jobs, and contributing less to mortgage offsets or redrawn facilities.

He says mortgage arrears will rise further as unemployment lifts, household savings deplete further and, more broadly, economic conditions navigate a period of weakness.

But arrears are unlikely to experience a material "blowout" unless labour markets weaken substantially more than forecast.

Add Category

Add Category