The gold bugs have been out and about since early last year when the market first starting mulling over the idea of a US rate cut in the next year or so.

US rate cutting cycles are among the bugs' favourite nourishment.

The inverse relationship between real US Treasury yields and gold prices is well established – if you're not getting much a return from bonds, park your "hard-earned" in gold is part of the theory.

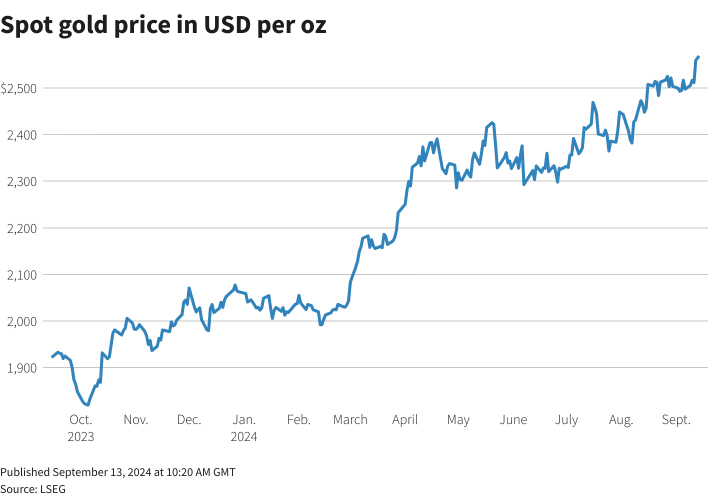

The bugs started hatching in serious numbers around February when US Fed Fund market started pricing in a new cycle of rate cuts, the first such cycle since the pandemic.

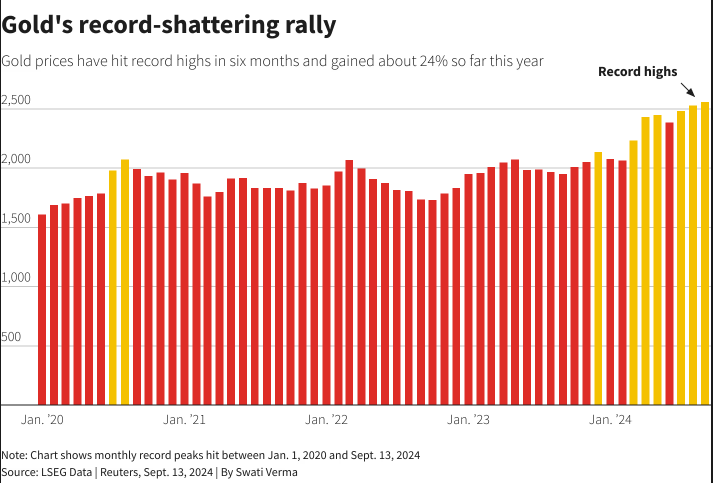

LoadingAs the likelihood of deeper cuts firmed, something like 200 bps over the next 12 months, gold bug activity has become a full-blown infestation with gold price racing through $US2000/ounce and now out beyond $US2,500 – up 24% for the year to date, and on track for its best performance since 2020.

$3,000? Why not? the bugs ask.

It largely pivots on how deep the Fed cuts and how much of that is already priced in.

The price rise has also been supported by heightened geo-political risk, central bank buying of bullion and a shortage of supply.

Weak US data, particularly in the jobs market and the potential for an outsized 50bp cut in November or December could fire up another spurt of gold mania.

Citi's US head of commodity research Aakash Doshi published a note suggesting gold could reach $2,600 by the end of the year and hit $3,000 mid-2025 driven by U.S. interest rate cuts, strong demand from exchange traded funds and over-the-counter physical demand.

Macquarie raised its gold price forecasts last week and is now looking for a quarter average cyclical peak in the first quarter next year of $2,600 per ounce, with potential for a spike towards $3,000.

"While the backdrop of challenged developed market fiscal outlooks remains structurally positive for gold, a lot is arguably already in the price, with the potential for cyclical headwinds to emerge later next year," analysts at Macquarie cautioned in its research note.

Over at J.P. Morgan analysts have also revised up their forecasts to $2,630 for the end of the year and $2,687 in 2025, 7% higher than earlier forecasts.

"Consensus estimates of ~200bps of cuts to the Fed rate to come over the next year are likely to keep the rally intact, but we note market estimates of declines in real yields are more subdued," J.P Morgan's Al Harvey wrote in a weekend note.

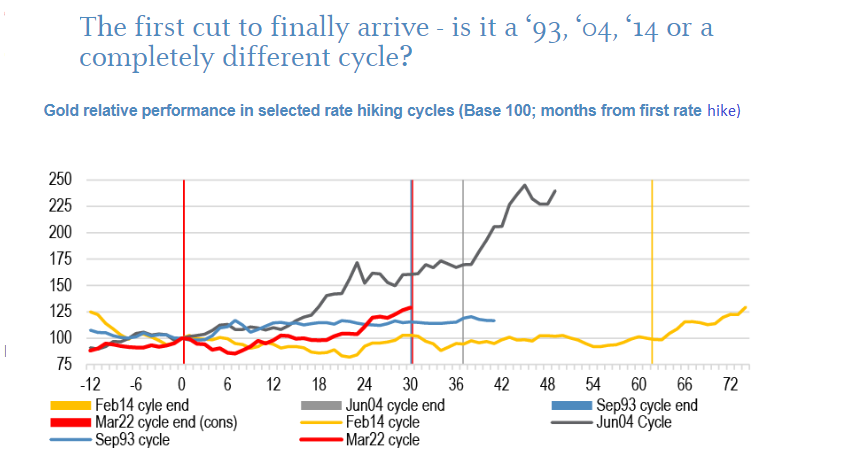

Mr Harvey noted this rally may be bit different given the extended period of speculation over the new rate cut cycle and the fact they has already been a degree of gold buying well before the first cut.

"In prior cycles, gold prices have tended to bounce following (or very close to) the first rate cut.

"Expectations for the timing of the first rate cut have been volatile, as the market has digested choppy macro data; continually incrementally pushing out the timing of the first rate cut over the last 18 months.

"Positioning ahead of an uptick in gold pricing kicked off in earnest around the start of 2023, when the market viewed the first rate cut as occurring within the next 6-12 months.

"Despite the timeframe narrowing, the proximity to the first cut remained just out of reach.

"Compared to prior cycles, the uplift in gold prices has been relatively pronounced ahead of the cut, and gives pause for thought as to whether pricing can continue to trend higher from here.

Add Category

Add Category