As we head into the Christmas/Holiday period, how will that affect the inflation and interest rates seen today and on what things can we expect price increases/decreases following this data release?

- Toby

Hi Toby,

This is always an interesting question, because it's asking someone to predict how a population of people will behave. That can be tricky.

If you cast your mind back to the debate over the potential inflationary impact of the Albanese Govt's changes to the Stage 3 tax cuts, you might remember that some economists argued that the tax cuts would be inflationary.

The government had re-engineered those tax cuts to put more money into the pockets of middle- and lower-income households, and some economists feared it would worsen inflation because more people would have more money to spend.

But last week, Westpac economist Jameson Coombs circulated a note discussing the spending impact of those tax cuts.

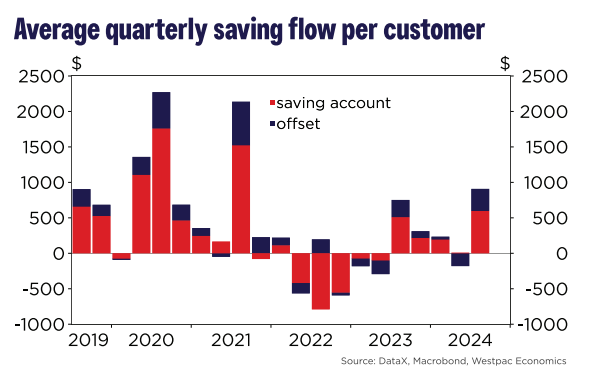

He estimated that households only spent 16% of the boost to their income from those tax cuts, and saved the other 84% as higher deposits and offset balances.

"This will be welcomed by the RBA," he wrote.

"The RBA Board has been alert to the upside risks to consumption from Stage 3 tax cuts and the implications a material lift in consumption would have for returning inflation to the target band."

Mr Coombs even warned that if Australians continued to bank their savings and not spend, if could have implications for the RBA's recovery plans.

"If households are more reluctant to spend the improvement in their disposable income from tax cuts, this could have broader consequences for mediumterm consumption activity," he said.

"In particular, the anticipated recovery in household spending once the RBA declares victory on inflation and monetary policy settings return to a more neutral stance may also be less pronounced."

But he also made a similar point about consumer psychology and the difficulties of predicting behaviour.

"Of course, this is predicated on consumer behaviour staying the same," he said.

"But consumer behaviour can easily change, often quickly.

"Over time, households may begin to spend a larger share of the income boost from tax cuts. Hence, it’s important to monitor changes in behaviour over time and update the outlook accordingly."

So to your point.

If millions of people rush out to spend this Christmas-Holiday period, and it does lead to a material increase in consumption and more inflationary pressures, it could well delay the RBA's rate cuts.

But it all depends. And as much as I dislike the phrase, we'll have to wait and see.

How are you and your friends feeling? Will you be rushing out to go nuts at Bunnings and Kmart?

I'm not really in the festive mood this year, given the state of the world. And it's the same for many people I know.

But the RBA Board's meeting next week to discuss interest rates, so we'll get a chance to hear how RBA governor Michele Bullock is thinking about the economy when she holds her usual press conference.

Add Category

Add Category