So just what is and when is this Santa Claus period that so excites the market?

When does the "Santa rally" start and end?

The etymology of the phrase is credited to the founder of the US-based Stock Trader's Almanac Yale Hirsch who defined it as, " the last five trading days of the year combined with the first two of the following year".

So, from a purist's point of view, we haven't opened the rally window just yet.

December 24 will be the S&P 500's fifth last trading day of the year.

What happens?

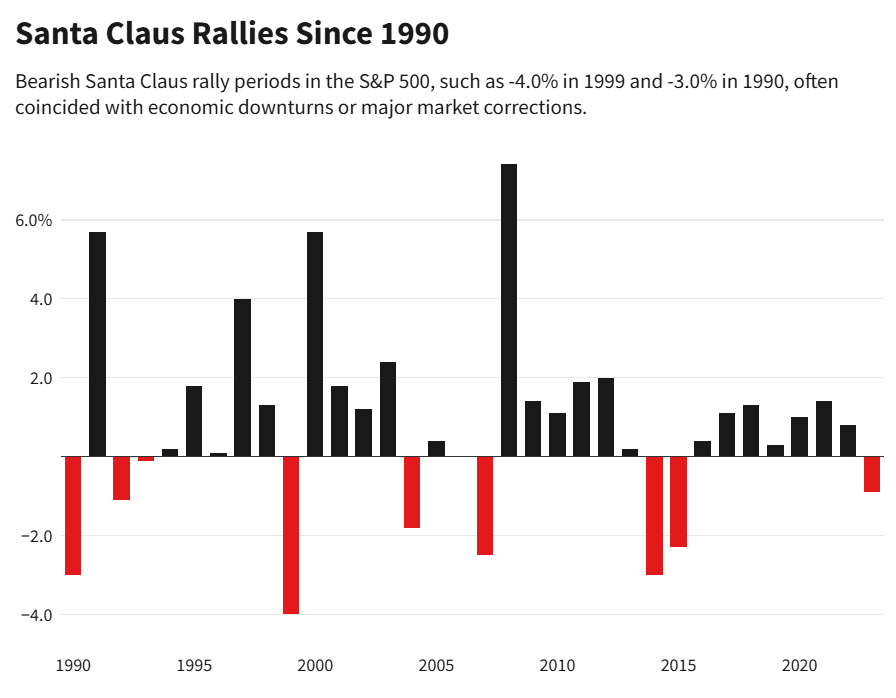

The Almanac notes since 1950, the Santa Rally has delivered an average gain on the S&P 500 of 1.3%

"Despite all of the high frequency trading and algorithmic trading and the velocity of the market these days…patterns [like the Santa Claus rally' continue to persist," Jeffrey A. Hirsch, Yale's son and current editor of the annual Stock Trader's Almanac noted.

Is it an immutable law of investing?

Nope. There are plenty of times the sleigh has crashed such as 1999 when the S&P 500 dropped 4%.

There was only a minor bingle last year when the market lost 0.9%.

Why does it happen?

Assuming it is a real thing, Investopedia lists a number of unproved theories about the "Santa Claus Rally".

These include:

- increased holiday shopping

- seasonal optimism

- end-of-tax-year considerations

- less institutional trading since many cut back on activity during the holidays.

Is that all?

The Santa Claus period, when combined with the following first five trading days of January and the performance of January overall, is also seen as a harbinger for the year.

When those three indicators are positive, the year has ended higher more than 90% of the time in the past 50 years, according to the Almanac.

As always, nothing in this blog should be seen as investment advice — particularly when the word "harbinger" is used.

Loading

Add Category

Add Category